salt tax cap new york

This consequential tax legislation available to electing pass-through entities provides a. Meanwhile property tax-lein sales ramp up in New York City Michigan takes steps to land a 25 billion General Motors battery plant and Washingtons governor says no to tax cuts.

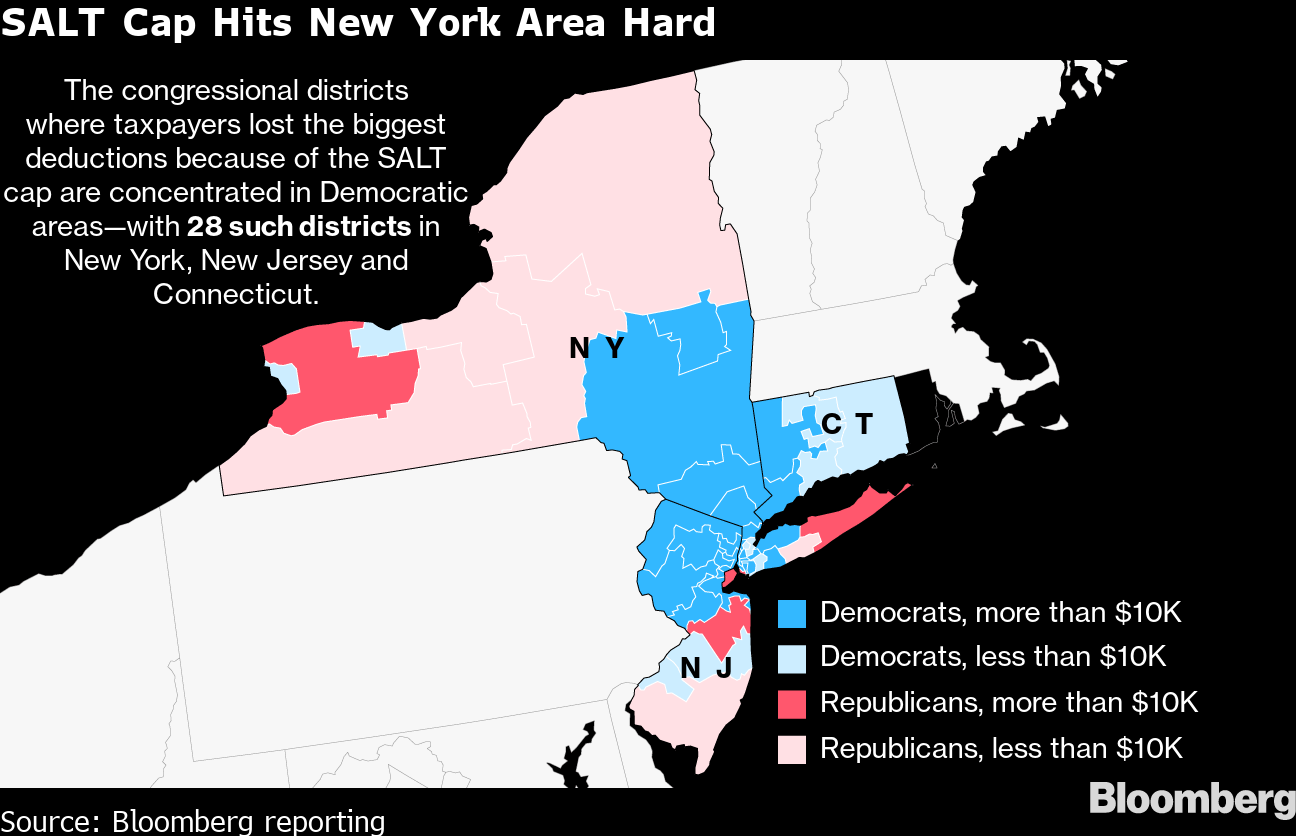

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

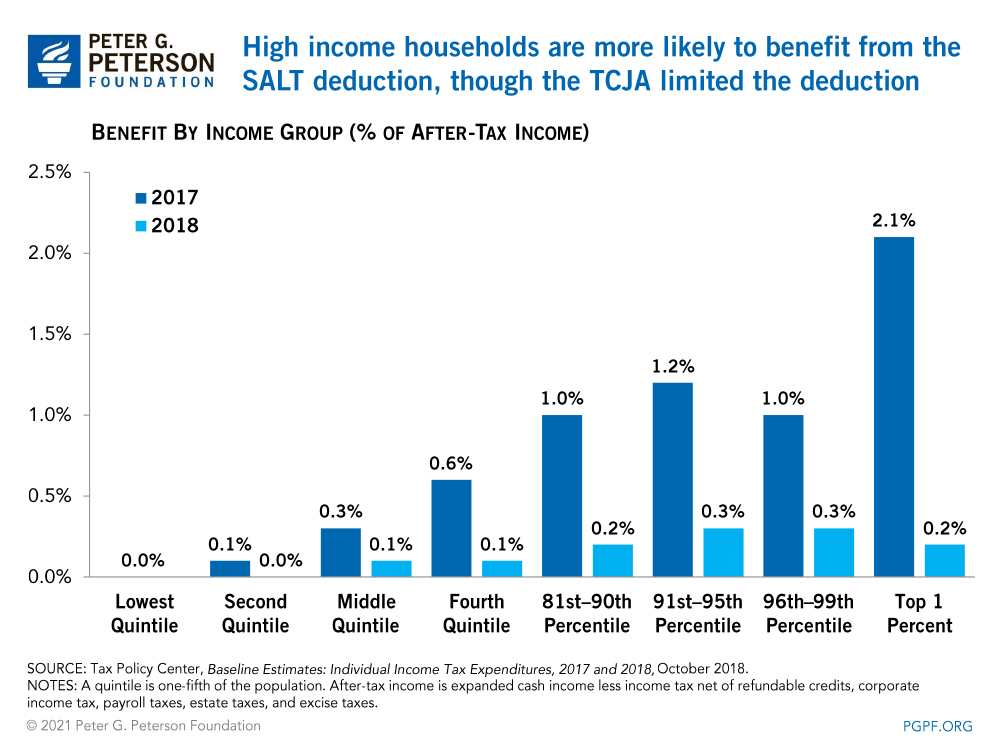

The SALT deduction tends to benefit states with many higher-earners and higher state taxes.

. Unlike most states New Yorks fiscal year begins early on April 1 so it was motivated to act quickly. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation.

Kathy Hochul and Attorney General Letitia James filed a petition for justices to review a lower courts decision that the 10000 cap on state and local tax deductions known as SALT was politically motivated as New York and three other states fight to overturn the ruling in the US. In high-tax states business owners and taxpayers who opt to itemize deductions. The Pass-Through Entity tax allows an eligible entity to pay New York State tax.

Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly. In 2018 only 321 percent of those filers itemized. This was true prior to the SALT deduction cap and remained the case in 2018.

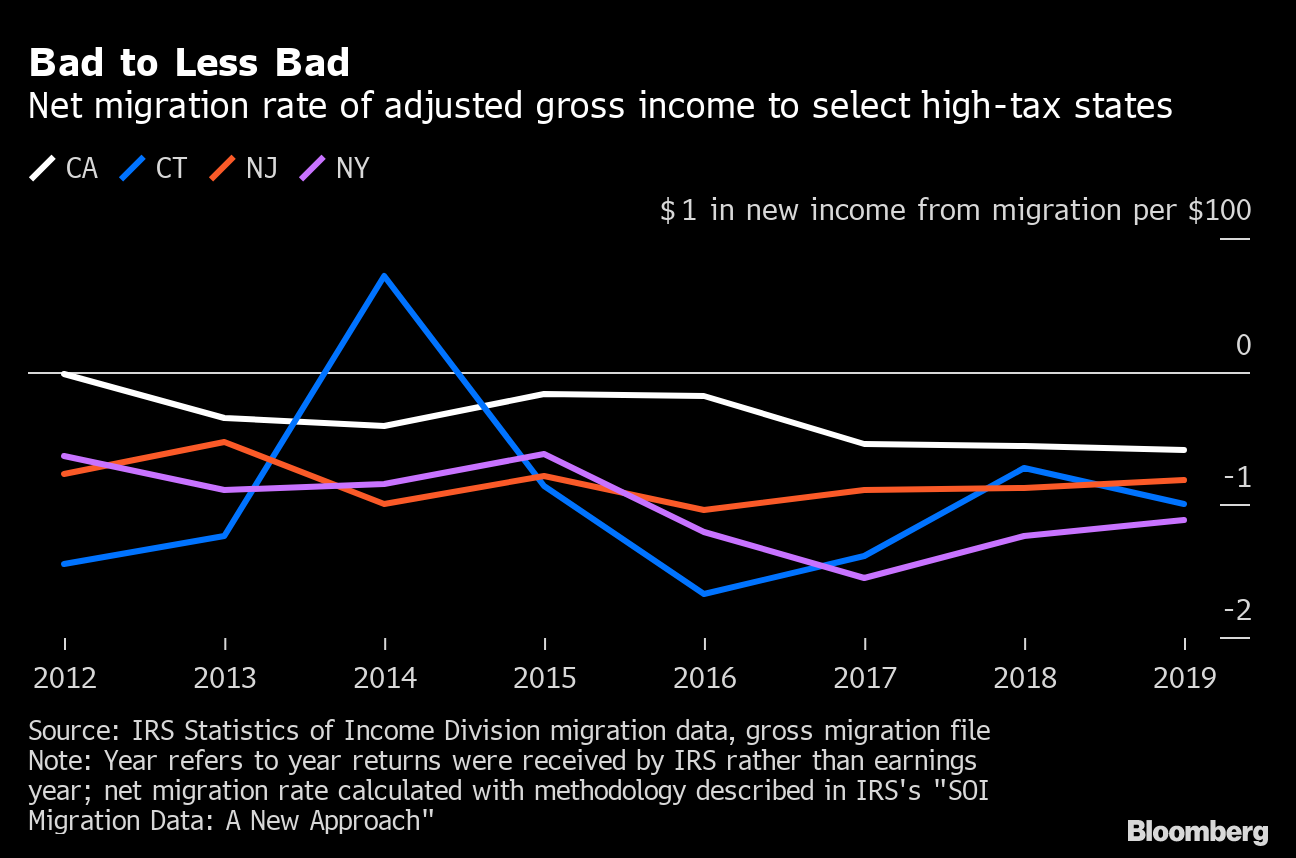

The SALT cap increase will have the biggest effect on high-income-tax states like New York California and New Jersey said certified financial planner Matthew Benson owner at Sonmore Financial. New Yorks new guidance on how to get around the 10000 federal cap on state and local tax deductions isnt offering some taxpayers the reprieve they were hoping for. The federal tax reform law passed on Dec.

This provision is not available for publicly traded partnerships. The SALT cap essentially resulted in a pretty large tax increase for a lot of families in the suburbs of New York City Mr. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that the Trump administration limited to 10000.

The existence of the SALT deduction and its cap most affect high-income taxpayers taxpayers living. New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

A writ of certiorari was announced late on Monday calling for the. 11 rows Starting with the 2018 tax year the maximum SALT deduction available was 10000. The SALT deduction applies to property sales or income taxes already paid to state and local governments.

The provision was part of Gov. While a report by the Rockefeller Institute in New York noted New Yorks overwhelming role in supporting federal. Bernie Sanders D-Vt is vowing to tweak the SALT provision perhaps by lowering the new cap to 40000 andor imposing an income limit of 400000 to benefit from it.

This week in state tax news. SALT paid by the. Maybe most notable is whats not in here said Tim Noonan a tax attorney at.

Before the creation of a cap on this deduction 91 of the benefit of the SALT deduction. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before dropping it back to 10000 in 2031. This year states rushed to enact workarounds to the 10000 cap on the state and local deduction.

With Democrats in power those homeowners are. The expansion of the standard deduction further limited the value of the SALT deduction for taxpayers under the 10000 cap. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation.

The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017 and without pointing fingers it seemed to many like it may have been taking a shot at blue states that tend. The deal which was included in President Bidens. The SALT cap limits a persons deduction to 10000 for tax years beginning after.

1 2021 New Yorks pass-through entity tax PTET will allow partnerships except publicly traded partnerships and entities that are treated as S corporations for New York purposes an annual election to pay income tax on behalf of its owners. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. 52 rows States that benefit most from the SALT deduction include California. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

New Yorks SALT Workaround. No SALT no deal they said. New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

Ny State Pass Through Entity Tax A S A L T Cap Workaround Fuoco Group

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

En Guzel San Francisco Fotograflari San Francisco At Night San Francisco Travel Moving To San Francisco

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

8 Cold Weather Tips For Cat Owners Playful Kitty Map The Weather Channel Weather Map

Dave Matthews Band Athletic Logo Trucker Hat Trucker Hat Dave Matthews Dave Matthews Band

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Stouffer 22k Gold Gilt Porcelain Salt Pepper Shakers Fine China Table Setting Decor Free Shipping Table Setting Decor Gilt Salt Pepper Shakers

Windmills For Electricity Electrify Your Life With Cheap Green Wind Power Solar Energy Panels Solar Energy Diy Concentrated Solar Power

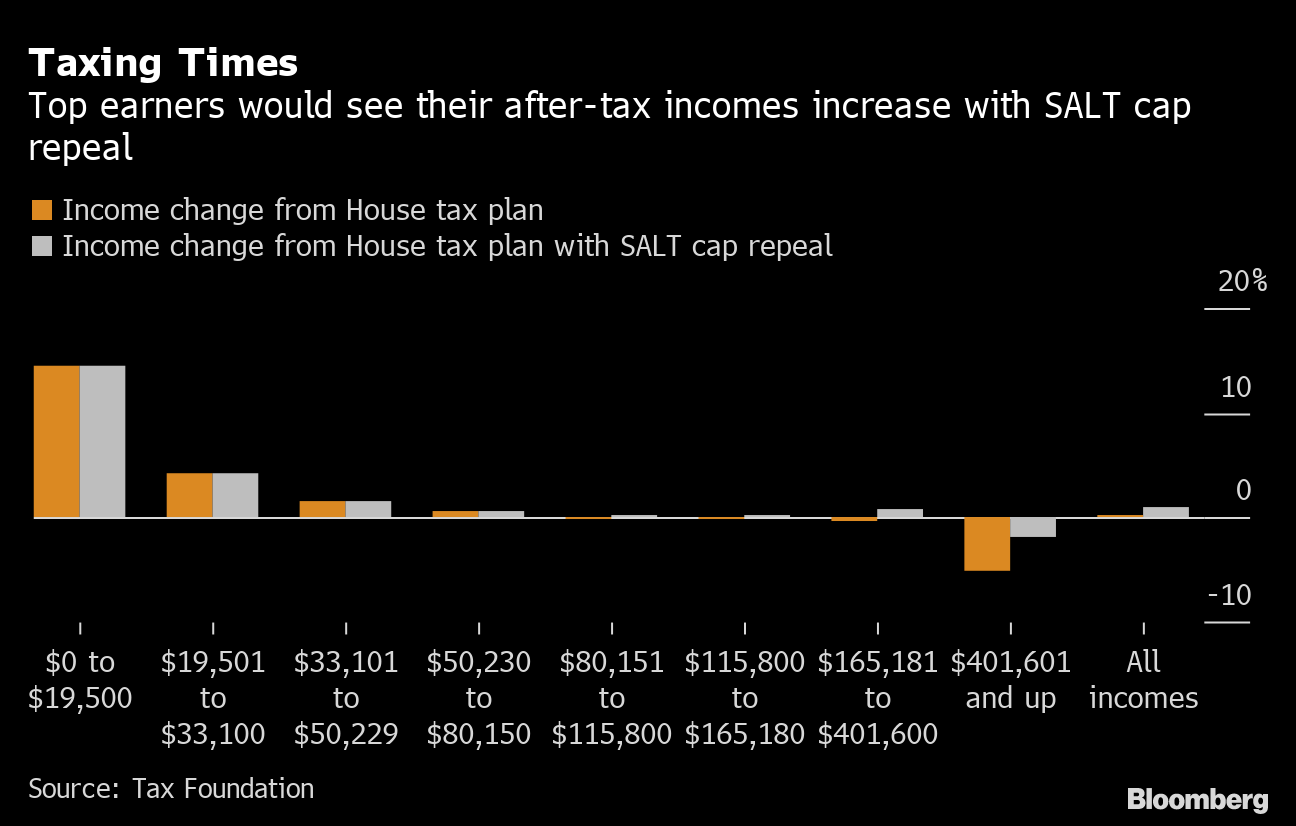

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

Vintage 1930s Snake Eyes Game Black Americana Excellent Graphics On Lid Of This Vintage Card Dice Game That Was Made In Eyes Game Game Black Vintage Cards

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

Solar Reserve Diagram Solar Generator Solar Power Plant Solar Power

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress